Bank transfers to the United States

Tips and answers to questions when sending bank transfers to the USA including how much you can send, how long it takes, and what accounts you can credit.

What currencies can I send to when sending bank transfers to the USA?

What information do I need from my recipient when sending bank transfers to the USA?

Which banks can I send to in the USA?

You can send transfers to any bank in the USA.

What type of bank accounts can I send to in the USA?

You can send to checking/current, savings and business accounts.

What currencies can I send to when sending bank transfers to the USA?

US Dollars (USD) only.

How much can I send when sending bank transfers to the USA?

The maximum amount per transfer is dependent on the country where you are sending from and the payment used to fund the transfer. Please see the relevant section in Payments for more info.

What information do I need from my recipient when sending bank transfers to the USA?

Full name. Please enter your recipient’s full name. To avoid any delays, the recipient’s name should match the name on their bank statement exactly.

Address. We need your recipient city.

Account details. We need your recipient’s (1) bank name, (2) account number and (3) ABA number.

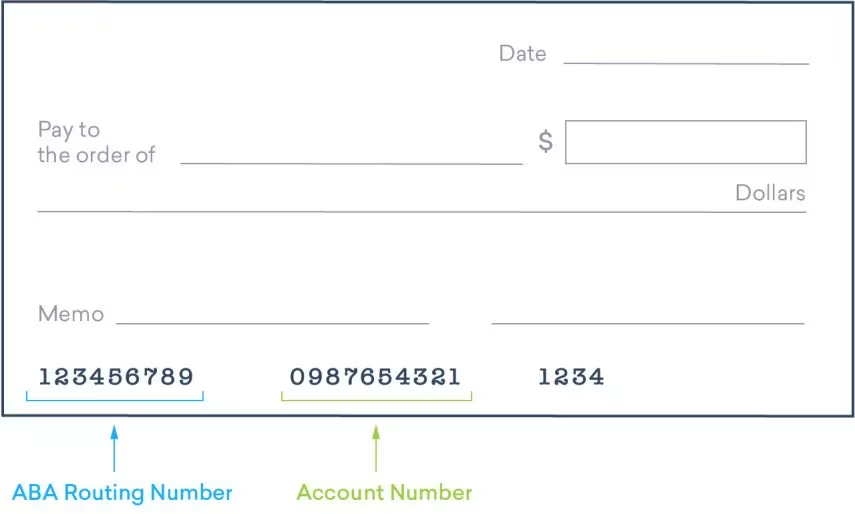

ABA/ACH routing code. These are 9-digit numeric codes for local payment. This is NOT the international wire transfer code. The ABA routing code can be found at the bottom left side of the recipient’s checkbook. You can read more about this below.

Mobile number. We ask for a contact number in case we need to provide any important updates.

Email (optional). We use this to send an email to your recipient with details of the transaction. This is particularly useful in case they have issues receiving the SMS notifications.

Sending reason. Please indicate whether it is “family or friend support,” “purchase of services,” “property payment,” or “sending fund to self”.

Please ensure that all your recipient’s details are correct. Once you make your transaction, it is difficult for us to amend or stop the transfer, although we will always try our best to do so.

What is the ABA Routing Number in the USA?

The domestic US ABA Routing Number is also sometimes called the Routing Transit Number (RTN), Electronic Routing Number or Checking Routing Number. It is the domestic code used to identify banks in the United States.

The ABA Routing Number is required along with the Account Number, Bank Name and recipient details to perform a transfer through WorldRemit.

The domestic US ABA Routing Number is 9 digits-long and composed of numbers only. It can usually be found on the bottom left hand corner of your recipient’s checks or on their recent bank statement.