Send bank transfers to the USA

Tips and answers to questions when sending bank transfers to the USA including how much you can send, how long it takes, and what accounts you can credit.

Which banks can I send to in the USA?

You can send transfers to any bank in the USA.

What type of bank accounts can I send to in the USA?

You can send to checking/current, savings and business accounts.

What currencies can I send to when sending bank transfers to the USA?

US Dollars (USD) only.

How much can I send when sending bank transfers to the USA?

The maximum amount per transfer is dependent on the country where you are sending from and the payment used to fund the transfer. Please see the relevant section in Payments for more info.

What information do I need from my recipient when sending bank transfers to the USA?

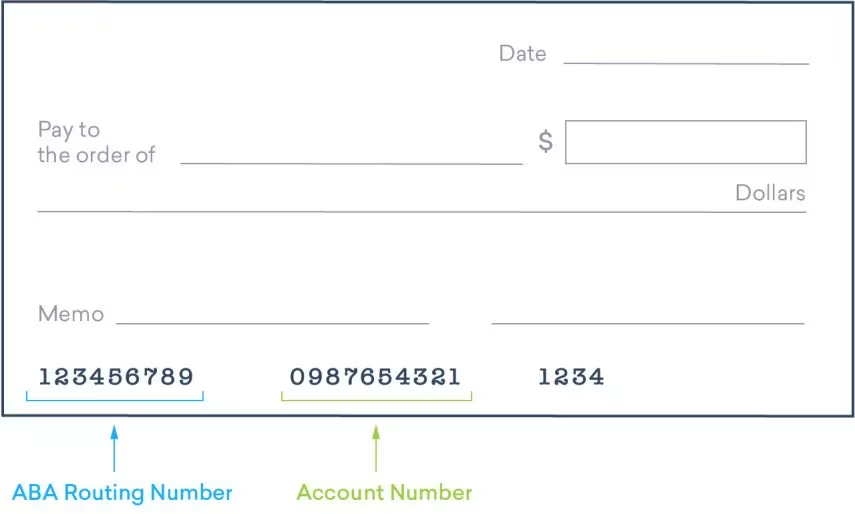

What is the ABA Routing Number in the USA?

The domestic US ABA Routing Number is also sometimes called the Routing Transit Number (RTN), Electronic Routing Number or Checking Routing Number. It is the domestic code used to identify banks in the United States.

The ABA Routing Number is required along with the Account Number, Bank Name and recipient details to perform a transfer through WorldRemit.

The domestic US ABA Routing Number is 9 digits-long and composed of numbers only. It can usually be found on the bottom left hand corner of your recipient’s checks or on their recent bank statement.