Choosing the best WorldRemit payout option for your needs

Each day thousands of people working overseas send money home to support their family and friends. Whether it’s a small amount or a large sum, it’s important that it reaches its destination safely and quickly.

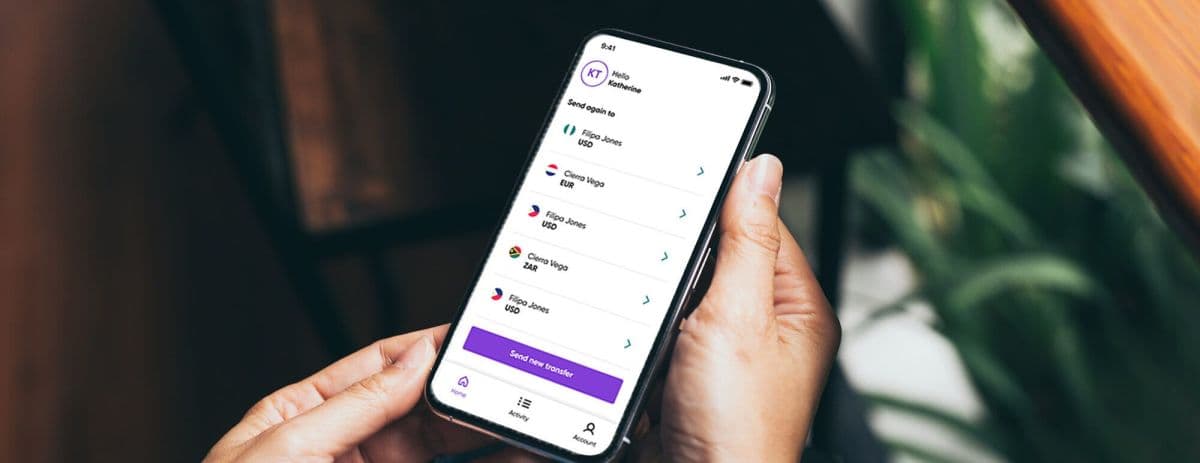

WorldRemit makes transferring money home as simple as possible. In fact, we offer four different international payment options, with 95% of all transfers arriving within ten minutes. Here’s your quick guide to our payout services:

WorldRemit Content Team

• 2 mins read • Updated

Bank transfers

Bank transfers are electronic payments, where you send money directly from your bank account to the bank accounts of your family or friends worldwide.

Speed

You can make bank transfers via our website or app, and depending where you’re sending money to, it’ll arrive instantly or within 1-2 days. Transfers are usually credited in the recipient’s account within one working day, and you can check how long your transfer will take here.

Cost

This varies depending on where you’re sending money to. The good news is that WorldRemit won’t charge any fees on your first transfer with us. Check out our rates here.

Locations

You can send money to over 130 countries with WorldRemit – see the full list here.

Transfer limits

There can be limits, but these depend on a number of factors including the country you’re sending to and our local partner’s transaction limits.

Find out more about WorldRemit’s bank transfers here.

Airtime top up

Having access to a pre-paid mobile phone is essential in so many developing countries, but the cost of calls, texts and mobile data can be expensive. WorldRemit makes it simple for you to send your family and friends an airtime top up whenever their credit is running low.

Speed

Mobile airtime top ups are usually added instantly or within a few minutes.

Cost

This varies country by country as a number of governments around the world have chosen to apply taxes to incoming airtime top ups. But we’ll make this clear before you complete any transfer.

Locations

You can send top ups to all of the countries found here.

Find out more about WorldRemit’s airtime top ups here.

Cash pickup transfer

Although paying by card is the most common way to buy things here, using cash to pay for items is still the norm in many countries. A cash pickup transfer allows your family and friends to collect physical cash from a supported location within WorldRemit's local partner network.

Speed

Funds are usually available to collect instantly. However there are times where we may require additional information from you for your transaction to be processed. The person you’re sending money to will also need to provide valid photo ID and a transaction reference code, which we’ll text them when the money is transferred. Due to COVID-19, there has been an impact on the number of locations that are open to collect cash from, and more details can be found here.

Cost

With cash pickup transfers, the recipient won’t be charged anything when collecting their money, and all costs to you will be laid out prior to the transfer. Check out our rates here.

Locations

You can send cash pickups to all of the countries found here.

Find out more about WorldRemit’s cash pickups here.

Mobile money

Mobile money is an electronic wallet service. Put simply, it allows users to store, send and receive money using their mobile phone. Because it’s safe, simple to do, and can be used on both smartphones and basic feature phones, sending electronic payments via mobile money is very popular.

Most mobile money services allow users to purchase items in shops or online, pay bills, school fees, and top up mobile airtime. It can also be used to forward money to others and make cash withdrawals at authorised agents.

Speed

Mobile money is superfast, secure and convenient, allowing you to send and receive funds instantly.

Locations

WorldRemit offers mobile money transfers to dozens of countries around the world, and you’ll find the full list of countries here.

Simplicity and safety

With mobile money there’s no need for a bank account as the funds are held in a mobile money account and are protected by local financial regulations. However, like a bank, we do store a record of every transaction and account balance, so if the phone or SIM card is ever lost or stolen, the user’s money is kept safe. Additionally, every transaction requires identification in the form of a secret PIN.

Send money with confidence

There you have it – four great payout options from WorldRemit. With speed, security and simplicity at the heart of them all, you can trust us to transfer your money abroad safely.

Want to try us today? Download our app, or explore our website.

Go to the appBack to home

WorldRemit allows customers to stay connected and support their loved ones. Our Content Team plays an integral part in that. We celebrate the global community and help you to achieve your ambitions.