What is a RIB and how to find it?

A RIB (bank identity document) is an essential element for completing money transactions such as transfers or direct debits. It contains obligatory information (account number, IBAN, or even SWIFT) so that all operations, in France or internationally, can be carried out with peace of mind. Discover everything you need to know about the RIB and how to find it in a few minutes with the WorldRemit guide!

The RIB, which is a bank identity document, is a unique number associated with a physical person or a company. It's often associated with the identity card of the bank account.

WorldRemit Content Team

• 4 mins reads • Updated

What is the RIB used for?

A RIB mainly allows transfers to be received to your bank account. It's used to communicate your bank RIB to your employer to receive your salary, to healthcare insurance or your health insurance company to receive reimbursement for healthcare, or even services such as the CAF or job centre, to benefit from allowances.

By means of a direct debit mandate, the bank identity document allows recurring payments to be made automatically: rent, insurance, loans, energy bills, etc. It's very easy, you just need to provide your RIB to the provider you wish to pay, and sign a SEPA direct debit mandate.

The RIB is also an excellent way to allow you to send money, such as:

National transfers

Foreign transfers: whatever your country of residence and whoever the recipient, the RIB has a reference called IBAN, allowing money to be transferred anywhere in the world.

Where to find your RIB?

Finding your RIB is quick and easy! Thanks to the digitisation of banking services, it's possible to find your RIB:

At an automatic cash dispenser

At the counter of your bank

On your account statement received every month, in digital or paper format

On your personal banking space, via the website or application of your bank

In your cheque book

Tip: Think about keeping your RIB in a safe place (on your computer or your phone) or making copies so that you don't have to constantly look for your RIB if it's often requested.

Composition of the RIB

The bank identity document has various information, such as:

Information on the bank account holder: surname, name, or company name

The numerical data of the RIB: the bank code (5 digits), the branch code (5 figures), the account number (11 figures), as well as the RIB key (2 figures)

The address of the bank (name + town + name of the branch)

IBAN: the international account number that allows sending and receiving money in France and abroad. It's made up of the same figures of the RIB number but in a different order

The BIC/SWIFT code: the international identification code of your bank

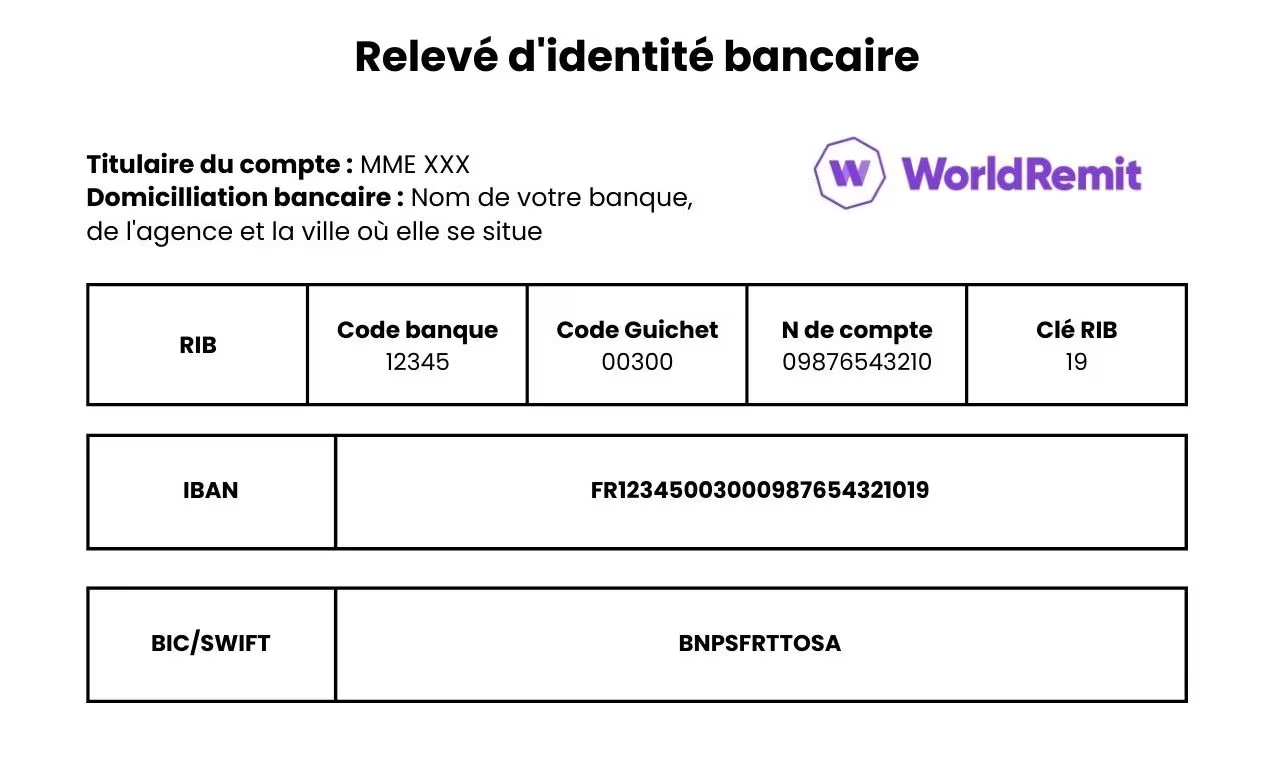

Example of RIB

How to read a RIB? Are you unsure of the exact composition of a RIB? Here's an example RIB to clarify things:

Bank Code 12345 Branch Code 00300 Account number 09876543210 RIB key 19 Crédit du Nord - Paris - Louis Blanc.

Is it dangerous to give out your RIB?

Sending your bank RIB is not a trivial action, because it contains private personal information. However, withdrawing money with a RIB requires authorisation from you. Also, while we advise not leaving your RIB lying around anywhere, there is no great danger in communicating your bank identity document.

Conversely, other means of payment are subject to certain risks and it's preferable to be careful not to send money just anywhere. To find out more about how to protect yourself from scams on money transfers, read our article on the subject.

In summary, the RIB is a number containing different information useful for correctly undertaking banking operations (transfers and direct debits). It is established fully as a bank identity card. Among this information: the SWIFT or IBAN, necessary for transferring money, especially abroad.

Do you want to send money abroad? WorldRemit can help you and make it easier for you by helping you make international money transfers.

Using WorldRemit allows you to send money to over 98 countries,

The transfer is easy, quick and secure,

The transfer rates and fees are transparent.

Do you want to know more about our services? Visit our website or contact one of our advisors.

RIB: FAQ

Do you still have questions about the RIB? Here are some answers to give you all the information on the RIB!

What is the difference between RIB and SWIFT?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is just an international identification of a bank. It is located on all RIBs. The SWIFT code is also known by the name BIC, the Business Identifier Code. Created to streamline transfers and direct debits within the Euro zone, the SWIFT is made up of 8 to 11 digits:

the country code (2 characters: FR for France, for example)

a bank code (4 characters)

a code on the location of the bank (2 characters) and a branch code (3 characters)

The SWIFT has no use without the IBAN, used for international transactions.

What is the difference between RIB and IBAN?

IBAN (International Bank Account Number) is just a bank account identification code, also international. It is a sequence of numbers with 14 to 34 characters:

The country code in 2 letters (FR, for example)

The control key, 2 figures following the country code

23 figures corresponding to the BBAN (Basic Bank Account Number), your bank account

Providing your IBAN is obligatory when you wish to make a transfer, in France or abroad. All RIBs contain an IBAN, however, each piece of information has a different use.

Is the account number the RIB?

Your account number is different from your RIB, which is more complete. However, the account number made up of 11 digits is part of the obligatory information appearing on the RIB.

Back to home

WorldRemit allows customers to stay connected and support their loved ones. Our Content Team plays an integral part in that. We celebrate the global community and help you to achieve your ambitions.