What is remittance advice? A complete guide

As cross-border business and travel grows, so does the need to send remittances. A remittance is a transfer of funds from one account to another, typically in a different country. It can be from one bank to another, but one of the main benefits of a remittance is that they can be sent and received in numerous different ways – including wire transfers, prepaid cards, cheque, mobile top-ups, or even collected in cash. Remittances can be payments for services or they can be gifts.

This means remittances are a more accessible means of money transfer for people who have less access to financial services – for example, those in rural communities. Remittances tend to be sent by migrant workers to their families in their home country (the world remittance comes from ‘remit’, which means to send back), although many international payments are considered remittances.

Remittances play a large role in today’s financial ecosystem – in fact, World Bank data shows remittances to low-and middle-income countries reached $605 billion USD in 2021. The amount of money being sent internationally is increasing dramatically, so what do you need to know about sending a remittance? In this guide, we look at remittance advice.

WorldRemit Content Team

• 6 mins read • Updated

What is remittance advice?

A remittance advice acts as proof of payment. You may hear it referred to as a remittance advice letter, slip, statement, note or similar. It’s a document which informs the receiver of a transfer that the payment has been sent, but it is not a guarantee it will arrive.

Remittance advice letters are typically sent by a customer to a business or supplier, to let them know that their invoice has been paid, but any remittance can use one.

If you plan to pay another party in another country for products, services rendered or for other reasons, it’s worthwhile having a working knowledge of international transfer methods and best practices. You may also be sent a remittance advice along with an invoice to fill out when paying. Nowadays remittance advice slips aren’t that common. In the modern digital era, most payments are done online and proof of payment is sent automatically and electronically once the payment is made.

But a remittance advice letter offers more than just proof a payment has been sent – its documentation that provides detailed information about the payment, including things like where the money has been sent and when. After all, remittance payments tend to be initiated by a sender, processed by a third party, and then received by another party in another country. Payments have variable timelines depending on the payment method so there can be a delay between when the invoice was sent and when the money arrives – as a result, any communication – such as a remittance advice slip – that happens during this time provides valuable visibility to all parties involved in the remittance. This is particularly useful if you’re making one payment which covers several charges.

For more information on remittances, we have a complete guide, including information on how to send a remittance.

Are remittance advice letters necessary?

Remittance advice letters may be sent between the following parties:

From a buyer to a seller

From an employer to an employee

From a financial institution to a payee

But sending a remittance advice letter with payment is not mandatory when transferring money. It’s more of a courtesy in customer-to-supplier transactions because it can help suppliers match the money they’ve received with your payment or invoice. Sending remittance advice letters is also more common with certain types of payment methods, like cheques.

Once a supplier sends an invoice, they may be anticipating the payment – but it’s unlikely to be the only invoice they’ve sent. Receiving remittance advice letters allows them to match their open invoices with incoming payments seamlessly. It’s useful for their record keeping.

Correctly allocating payments against invoices saves suppliers time, but it can also prevent possible confusion over whether you’ve paid and creates efficient communication between both parties. Maintaining good business relationships is important, so this act of courtesy can go a long way – especially if you plan on sending payments regularly.

What should a remittance advice letter include?

If you have to send a remittance advice slip, there are certain details to include. These are:

Your name and address

The supplier’s name and address (or the recipient of the payment)

The invoice number the payment relates to

The method of payment

The amount you’ve paid

The date you paid

When the recipient can expect to receive the payment

The contact details of who to contact if there’s any queries about the remittance

Some businesses will include a remittance advice section on their invoices, so it’s easier for the customer to fill in and return. If a supplier doesn’t include a remittance advice section in an invoice, it’s best practice to include the details listed above on company-headed paper or something similar.

Examples of a remittance advice

Because it’s not mandatory to send them, there are no legal guidelines for sending remittance advice. However, in the simplest form, it’s simply proof of payment that shows the invoice number and payment amount sent or enclosed (in the case of cheques).

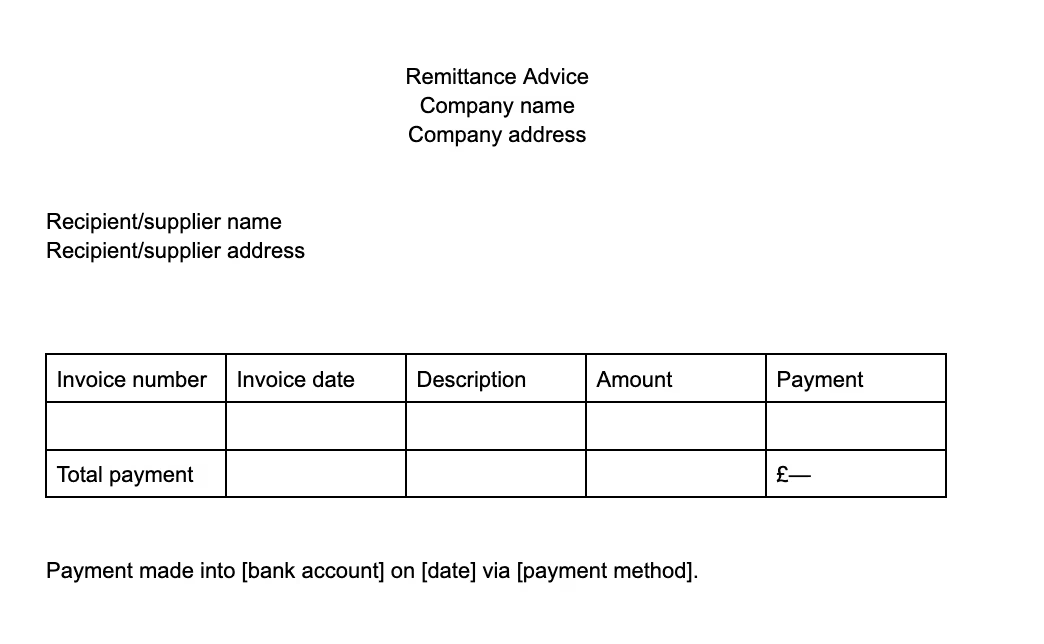

Here is a basic example, although company templates and details will vary:

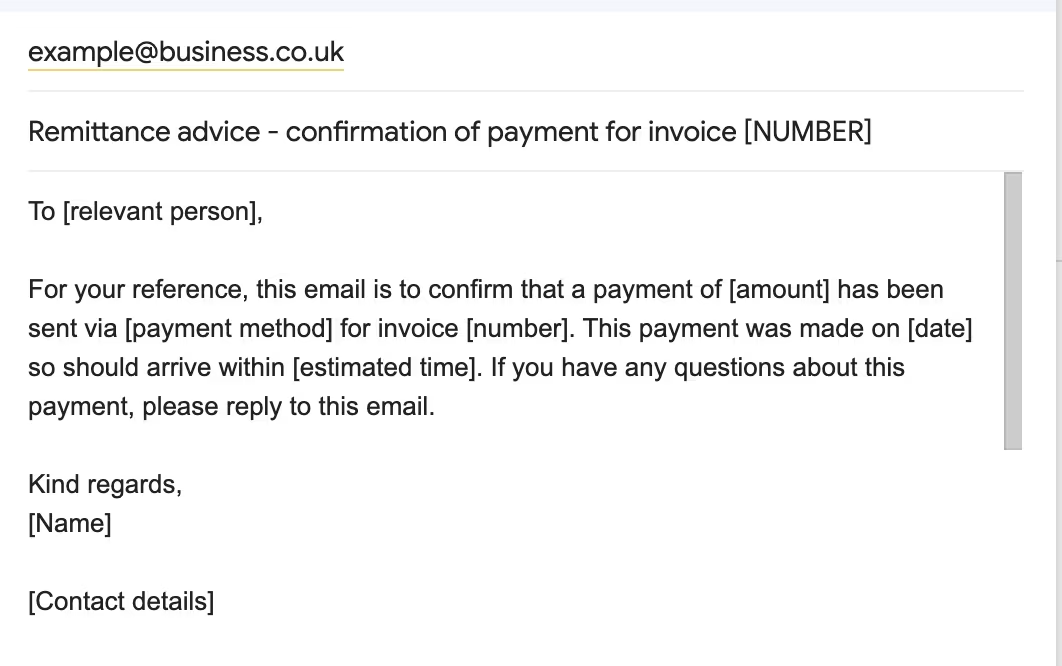

And here is an email example:

Best practice advice for sending and receiving remittance advice

Rather than leaving anyone in the dark regarding payments, a remittance advice letter provides valuable assurance. While it shouldn’t be considered confirmation that payment has arrived, it helps both parties keep track of the payment in process. We have tips for you whether you’re sending or receiving a payment:

What’s the best way to send remittance advice?

You can send a remittance advice:

Via email. Sending remittance advice electronically is probably the easiest – and most common – way. You can include all the necessary details in the email itself or attach a PDF or similar. Just make sure you have the relevant email to send it to, or it may get lost in a general company email address. If you’re paying electronically the remittance should be sent at the time the payment is made.

Via the post. If you’re paying by cheque, it’s common practice to send a remittance advice along with the cheque itself.

You can use templates to generate your remittance advice slips, create your own similar to the examples shared above, or you can use software which generates them for you. However you decide to send yours, remember the benefits: keeping suppliers in the loop, creating visibility and building trust.

What to do if you receive remittance advice

As we’ve discussed, a remittance advice letter is an indication that a payment has been made. It’s generated or created when a payment is released, so it simply means your payment is on its way. Depending on the payment method (this should be detailed on the remittance advice slip), you may not receive the remittance payment immediately. For example, a slip will be sent along with a cheque – you would then need to cash that cheque and wait for it to clear.

There are a number of reasons a payment may not arrive (for example, insufficient funds or incorrect details), so after you’ve received a remittance advice slip be sure to keep an eye out for the money in the account outlined in the letter. You should keep a copy of all remittance advice slips sent and received so there’s documentation to refer to if any errors need to be corrected or if outstanding balances need to be determined.

Remittance advice: FAQs

Do I need to send remittance advice?

No. It is up to you. The purpose of a remittance advice slip or letter is to let someone else know you’ve paid their invoice. Having this greater financial clarity is useful for them and you, but it is up to you if you send one.

Do I need to keep a copy of all remittance advice slips?

It is good practice to keep copies of remittances you send to suppliers and those that you receive from customers. If there are any queries about payment in the future, you can refer back to the remittance advice for details.

Is remittance advice the same as a receipt?

Remittance advice notes and receipts both offer proof of payment. But a receipt is given from a business to a customer at the point of sale, typically with an immediate credit or debit card payment. Remittance advice is sent from a customer to a business when they’ve started the payment process. They aren’t needed with most retail transactions, where receipts are used, since the payment is automatically associated with the customer’s purchase.

If you need to send a remittance or other money transfer, WorldRemit offers a complete waiver of service fees for your first three transfers. We make sure your money is delivered quickly and easily. You can choose from our network of trusted banks, cash pickup locations or mobile money, to ensure your transfer reaches where it needs to in a suitable way.

This communication is intended for marketing purposes only and does not constitute or provide legal, tax, investment or financial planning related advice.

Back to homeWorldRemit allows customers to stay connected and support their loved ones. Our Content Team plays an integral part in that. We celebrate the global community and help you to achieve your ambitions.